Reach Subsea - $REACH.OL Q4 Update (eng)

Stabilization after strong growth – focus on margins and the remote fleet

This information does not constitute investment advice. It is for informational purposes only and should not be used as a basis for investment decisions.

Introduction

On February 13, 2025, Reach Subsea released its Q4 results. In the following, I summarize the key points from the results, the earnings call, and relevant news from the past three months.

Results at a Glance

Reach Subsea achieved revenues of 684 million NOK (approximately 58.65 million EUR) in Q4 2024, representing an increase of 44% compared to the previous year. For the full year, revenue amounted to 2.717 billion NOK (approximately 233 million EUR), a growth of 36%.

EBITDA increased by 12% in Q4, reaching 81 million NOK (approximately 7 million EUR). For the full year 2024, the company reported EBITDA of 338 million NOK, representing a moderate 10% increase.

Net profit declined by nearly 10%, primarily due to negative currency effects (positive impact in 2023 vs. negative impact in 2024) and a one-time effect from the sale of an ROV in 2023 for 30 million NOK. For the full year 2024, net profit was 204 million NOK (approximately 17.49 million EUR), while in Q4 2024, it was only 21 million NOK (approximately 1.8 million EUR).

Additionally, management reported that some revenues and profits from Q4 were shifted into Q1 2025.

Key News in Q4

The most impactful event this quarter was the partial sale of nearly 10 million shares by Wilhelmsen on December 5. Wilhelmsen sold approximately 20% of its stake, which was originally acquired in 2022 to financially support the Reach Remote project. This move came as a surprise to some investors.

However, it is important to note that the share sale was executed through warrants with a strike price of 3.28 NOK. Wilhelmsen achieved a 150% return on this transaction. Future sales should, therefore, be logically expected and no longer come as a surprise.

In contrast, a positive insider transaction was reported: A board member purchased approximately 94,000 shares at a price of 7.90 NOK.

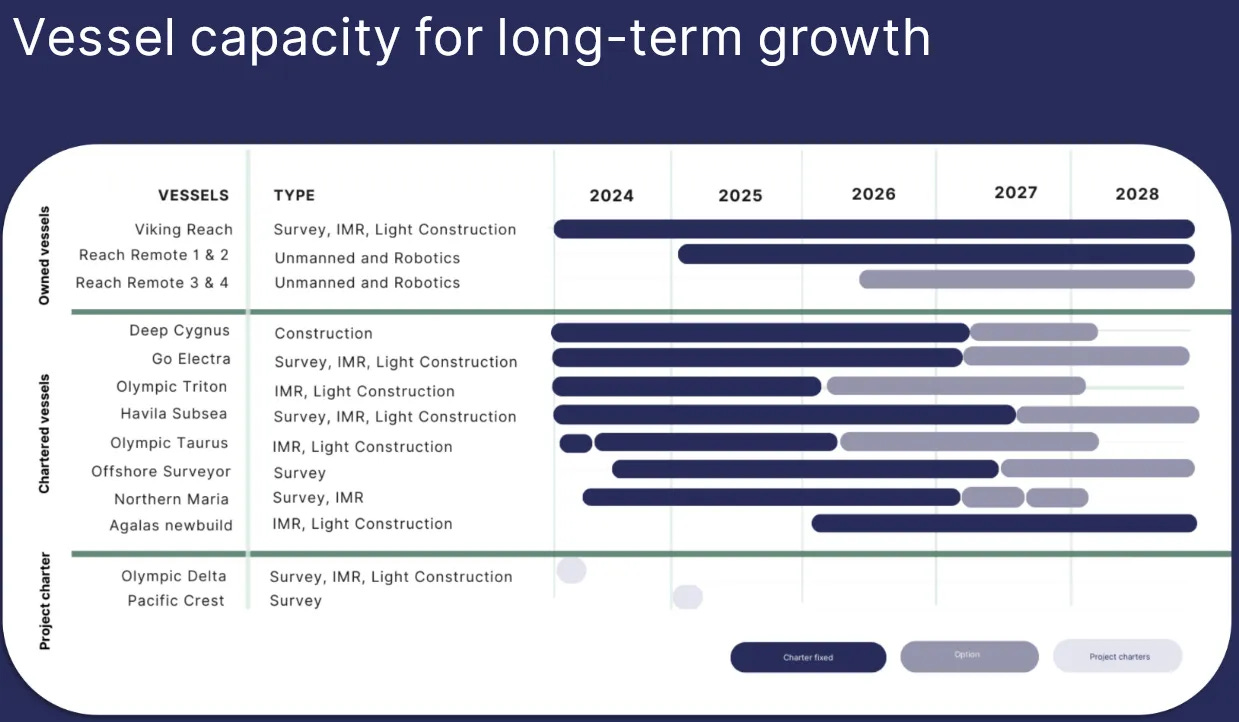

From a fundamental perspective, the delivery of the first Reach Remote vessel was confirmed, and a new vessel is planned for spring 2027.

Evidence of Consistency

As this is now my third quarterly update, I believe I can somewhat assess the quality of management. One key aspect, frequently emphasized by one of my most respected investor colleagues, is consistency—specifically, the consistency between management’s statements and the actual results delivered.

Looking back at my previous updates, one can see that my forecasts were often based solely on management’s statements—and they have been fairly accurate.

Therefore, I feel comfortable outlining my expectations for the next quarter and for 2025 as a whole.

What Trends Can Be Observed?

First, it is evident that the era of 50%+ revenue growth is over. Management is now pursuing a clear strategy of organic growth, while also seeking to acquire additional resources in the market.

In 2025, the company’s fleet will expand from eight to ten vessels, including Reach Remote 1 and 2. Assuming the current development of the Reach Remote vessels stays on track, the company will conduct cost-covering pilot projects in Q1 2025, with the first high-margin contracts expected in spring. As a result, Q1 revenue should fluctuate between 684 million NOK (Q4 2024 revenue) and 835 million NOK (Q3 2024 revenue).

Revenue growth of approximately 25% compared to the previous year is expected only from Q2 2025 onward, as the Reach Remote vessels will be fully operational by then.

The focus should currently be on margins, which have come under significant pressure this quarter. One reason for this is the postponement of certain projects and profits from Q4 2024 to Q1 2025. Additionally, management has highlighted rising supply chain costs, which they are now addressing.

On a positive note, the order backlog remains stable at 1.2 billion NOK, the same level as in Q4 2023, but with significantly higher margins than a year ago.

A Broad Outlook for 2025

This time, I do not want to create specific forward-modeling projections, as I believe the last forecast from the Q3 report remains largely valid. However, when considering EV/EBITDA, I am now focusing more on margin expansion than on revenue growth.

Instead, I would like to outline my rough expectations for 2025. I hope this will serve as a useful guide, and even more, I welcome well-reasoned critical feedback. If that happens, I will have learned something valuable and gained important insights.

Q1 2025

Revenue: Stable

Margin: Increasing

Potential Press Releases:

Additional orders for Reach Remote 2 & 3

First contracts for Reach Remote 1

Q2 2025

Revenue: +12% (driven by the deployment of Reach Remote 1)

Margin: Increasing (due to higher-margin contracts)

Potential Press Releases:

EU funding announcement

Potential further share sales by Wilhelmsen

Additional contracts for Reach Remote 1 & 2

Q3 2025

Revenue: +25% (driven by the deployment of both Reach Remote vessels)

Margin: Increasing (due to higher-margin Remote fleet contracts)

Potential Press Releases:

EU funding announcement

Potential further share sales by Wilhelmsen

Q4 2025

Revenue: +25% (sustained full operation of both Reach Remote vessels)

Margin: Increasing (due to higher-margin Remote fleet contracts)

Thank you for your time!