Unibap – A Pure-Play in the Space-Tech Sector

english

Price: 4.50 SEK

Exchange rate: 1 SEK = 0.088 €

Shares outstanding fully diluted: 62,304,860

Market cap: 280 million SEK (24.76 million €)

Enterprise value: 188 million SEK (16.63 million €)

I would love to start this write-up by calling this an "undiscovered gem" – a term highly appreciated by Fintwit. However, since the proof of true gem status is still missing, I can currently only use the adjective "undiscovered."

This pitch does not dive too deeply into technical details or competitor comparisons, as a well-founded assessment of such aspects is difficult for outsiders without in-depth expertise. It would be unprofessional to make a definitive judgment here, so it is up to each investor to evaluate the technology, its advantages, and its potential weaknesses against the competition.

Unibap provides computer and software solutions specifically designed for use in satellites. What makes it unique is that consumer hardware is integrated into a space-qualified enclosure. This allows for more computing power to be housed in a satellite compared to conventional hardware – a key advantage that I will elaborate on later.

Why is the company interesting right now?

Unibap serves three strong, long-term trends: space, edge computing, and AI

Unibap has partnerships with international space organizations

Unibap is showing early signs of recurring, high-margin software revenue

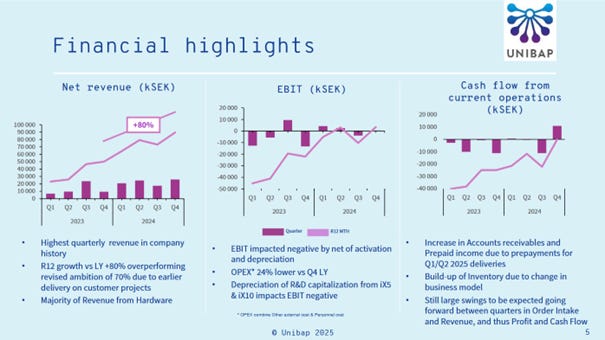

Unibap increased its revenue by 80% in 2024

Unibap could have an EV/EBITDA below 10 by the end of 2025

And why is no one talking about Unibap?

Unibap reports highly volatile revenues and has mostly been cash flow negative

Unibap has significantly diluted its shares (by 500% since early 2023)

Unibap reports almost exclusively in Swedish

Unibap – A Pure-Play in the Space-Tech Sector

Unibap was founded in 2013 and initially started in the field of automation technology. Over the years, the company gradually shifted its focus toward edge computing, AI, and space technology. With the CEO transition in 2022 and under the leadership of Johan Åman, Unibap accelerated this transformation and has since fully dedicated itself to the space-tech business.

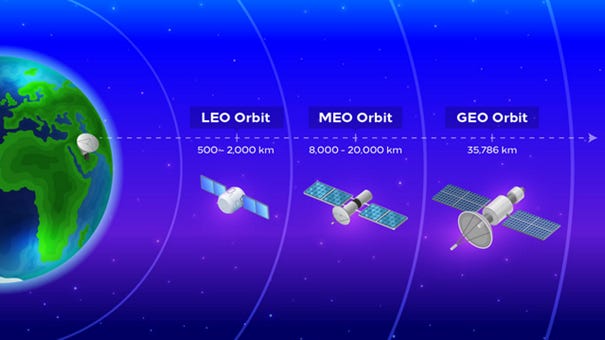

One key step in this strategic shift was the sale of its industrial business in Q3 2023, making Unibap a pure provider of space computing solutions. Today, the company develops computers and AI-powered systems for the space industry, enabling satellites to operate autonomously in orbit. These systems are primarily used in Low Earth Orbit (LEO) satellites, which, due to their low altitude of approximately 500 to 2,000 km, offer low latency and more cost-effective launches. LEO satellites are increasingly being used for communication networks, Earth observation, and military applications.

Unibap's edge computing enables satellites to analyze images and data directly in orbit instead of transmitting them to Earth. This significantly reduces latency, allowing for faster decision-making in critical applications. Processing data onboard also lowers operational costs by reducing bandwidth requirements, optimizing both data transmission expenses and network load.

An example of the advantages of this technology is the automatic detection of wildfires from space: satellites can identify fires in real-time and immediately alert emergency authorities, without delays caused by transmitting data to Earth.

The number of LEO satellites is expected to grow significantly in the coming years. Experts predict that the number of satellites in orbit could multiply by 2030, with estimates reaching up to 60,000 active LEO satellites. The main drivers of this growth are the rising demand for global internet coverage, improved Earth observation technologies, and new security applications.

Additionally, increased computing power allows for the integration of AI, enabling satellites to navigate autonomously in space—a capability that is becoming increasingly important as space debris continues to accumulate.

What kind of standard computing solutions are these?

Essentially, existing standard solutions from the consumer market are used. What makes Unibap unique is that it integrates this hardware into a space-qualified enclosure, capable of withstanding extreme temperature fluctuations and high radiation exposure in space.

For example, the new iX10 model features an AMD Ryzen V1000 CPU paired with an AMD Radeon GPU—components well known from both the consumer and industrial sectors. In addition to the iX10, the iX5, its predecessor, remains part of Unibap’s product portfolio.

This allows Unibap to provide high-performance hardware for space and produce it within a one-month timeframe. The company currently has a production capacity of 100 computing units per year and can scale up to 200 units without requiring significant investments.

In addition to its hardware business, Unibap has developed its own software solution, SpaceCloudOS, a Linux-based operating system. Its key advantage is its high accessibility compared to FPGA-based systems.

In 2022, Unibap successfully collaborated with Amazon to integrate SpaceCloud software with AWS services on Earth. Through this integration, applications running on SpaceCloudOS can access AWS services to leverage advanced features such as machine learning, data analytics, and cloud storage. This enables a seamless connection between onboard data processing in space and AWS cloud services on Earth.

How is revenue generated?

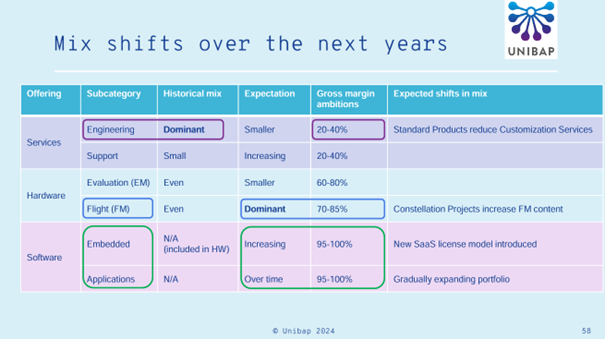

Unibap categorizes its revenue into three main segments: services, hardware, and software. While the services business previously involved customized solutions for satellites, the company is now shifting its focus toward hardware sales with COTS (commercial off-the-shelf) solutions—standardized computing solutions.

Additionally, Unibap is emphasizing the transition from qualification projects to serial production, aiming to leverage economies of scale and increase market penetration.

The company’s first standardized solution, the iX5 CPU, is already operational in space with nine units deployed. Its successor, the iX10, is scheduled for its first space launch in early 2025, providing further validation for the technology.

For 2025, Unibap plans to deploy over 30 computing units, consisting of a mix of iX5 and iX10 models.

The third pillar is the previously mentioned software business. This segment has potential for recurring revenue, with an initial long-term contract already secured.

In short, rising hardware sales will eventually drive higher software revenue, as more installed systems increase the demand for additional software and updates.

Sounds interesting – but what about the competition?

And how does Unibap plan to stand out?

As mentioned earlier, a definitive assessment is difficult due to the complexity of the industry. However, I would like to list some competitors so that interested investors can conduct their own research:

KP Labs appears to be the only competitor also using consumer-grade hardware. However, the company has so far completed only a few space missions. Additionally, the platform Satsearch could be of interest, as it lists a wide range of satellite components.

Ultimately, I can only refer to Unibap’s past partnerships and clients to support the quality of its technology. Since 2022, the company has collaborated with the following partners:

Ok, ok, got it – but what about the management?

Unibap has been led by CEO Johan Åman since 2022. Under his leadership, the company has undergone a clear strategic realignment, fully focusing on the space-tech segment. The sale of the industrial business in 2023 underscores this shift.

Åman has experience from various technology companies, but lacks deep expertise in the space industry. A critical point is the recent capital increase in Q2 2024, which came as a surprise to investors. In the previous capital raise, the liquidity situation for 2024 was still described as sufficient.

The reasoning—U.S. expansion and the entry of a new investor with U.S. connections—seems logical. However, the move raises questions about the management’s planning reliability and communication.

What does the shareholder structure look like after the capital increases?

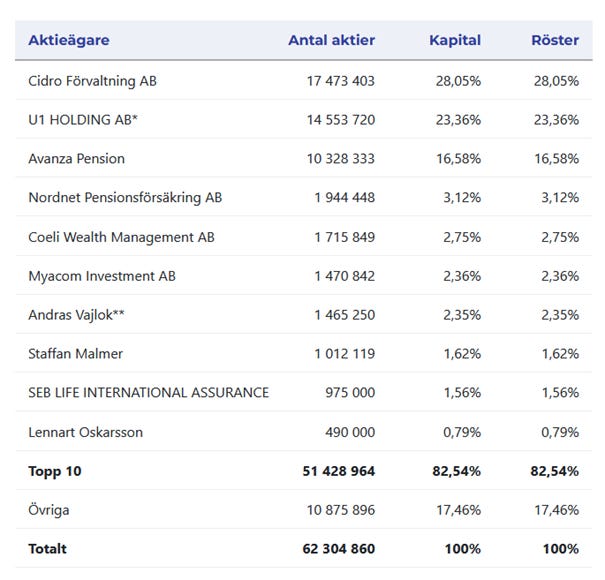

Peter Lindell, an experienced Swedish investor, holds nearly one-third of Unibap through his investment company Cidro Förvaltning AB. He is known for long-term, strategic investments in technology and industrial companies.

With almost 24%, Neqst also owns a significant stake in Unibap via the U1 Holding vehicle. Given its background with Carmenta and its U.S. business, Neqst could be a valuable asset for Unibap’s U.S. expansion—which aligns with the CEO’s statements.

Together, these two parties control over 50% of the company—a situation I do not favor but am willing to accept in this case.

Ultimately, Andras Vajlok, as a board member, is the only insider holding a significant number of shares. Additional incentives for management would be desirable.

What is the current valuation?

I will keep this section brief, as modeling a project-based business with fluctuating revenues is inherently difficult.

What is clear is that the capital increases have resulted in a solid cash position of 59 million SEK (5.2 million €) and that the company is debt-free. With loss carryforwards of nearly 196 million SEK (at a Swedish tax rate of 20%), this leads to an enterprise value (EV) of approximately 188 million SEK (16.63 million €).

Unibap is at a turning point toward sustainable positive quarterly results. Based on management guidance, which forecasts 30% to 50% revenue growth, and an assumed moderate cost increase of 10%, this results in a potential EV/EBITDA valuation between 6 and 18.

This thesis is further supported by the announcement of Q4 2024 order intake, totaling nearly 50 million SEK, which represents 55% of Unibap’s total revenue for 2024.

One final remark:

In the Q2 2024 cash flow statement, there are discrepancies in the reported figures for "cash balance at the beginning" and "cash balance at the end." These obvious errors no longer appear in the subsequent reports.

This is an issue I have not yet been able to resolve.

Summary

From my perspective, Unibap is a highly interesting company, but it comes with many open questions and uncertainties that I have not yet been able to fully resolve. As a result, I currently hold only a starter position and plan to expand my knowledge with upcoming quarterly results to adjust my investment decision accordingly.

As always, I appreciate your feedback and thank you for your time!